Missing fundamental, internal or external factors

Franchise Evaluator™:

The Maids Franchise

Franchise overview of The Maids franchise opportunity based on 14 internal and external factors.

Franchise at a Glance

President, Chief Executive Officer, and Director: Daniel F. Kirwan

Mr. Kirwan joined us as Vice-President and Chief Financial Officer in January 2001. He was promoted to Executive Vice-President Operations, Treasurer on January 1, 2003. In September 2010, he was promoted to Chief Operating Officer. In March 2020, he was promoted to his current position. Mr. Kirwan has been a member of our Board of Directors since November 2002.

Year Founded: 1979

Year Started Franchising: 1980

We grant the personal right and license to establish and operate a The Maids® household maintenance and home services business (“The Maids® Business”). Under the terms of the Franchise Agreement (which is attached as Exhibit D), you will operate your The Maids® Business within a prescribed territory. The Maids® Businesses provide efficient household cleaning services for people who lack the time or desire to clean their home on a regular basis. It will be your sole responsibility for locating any customer accounts, and you must purchase or lease one vehicle for each maid team used in your The Maids® Business. We may require you to use the Mr. Clean® trademark in the operation of your The Maids® Business, but we do not anticipate that it will be the primary trademark.

We have been franchising The Maids® Businesses since November 1980.

Corporate Address

The Maids International, LLC

9394 West Dodge Road, Suite 140

Omaha, NE 68114

(402) 558-5555

Fax: (402) 558-4112

Website: www.maids.com

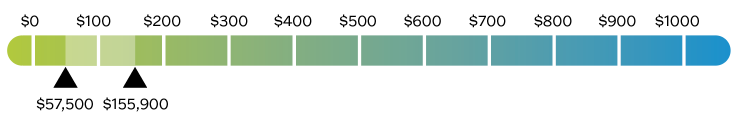

Investment Range

Initial Franchise Fee

Royalty

Ad Fund

Financial Performance Representation

Does this franchisor make an earnings claim?

(Item 19 from FDD)

Locations

Franchised & Company-Owned Territories

Franchisees Licensed & Operated

Seven External Factors of the Franchise Evaluator™

Scoring Scale: 1 = Lowest 10 = Highest

Market Size

What may at first appear to be a mature market, the residential home cleaning market may actually be a growth with the increasing adoption of external cleaning services across several segments.

Industry Trend

The industry seems to be trending upward with not only the adoption new households engaging home cleaning services for the first time, but new services being introduced such as allergen free cleaning, disinfection and green cleaning products.

Product and Service Drivers

This is a want based as opposed to need based service. However, in some sectors, like the growing geriatric population, outsourcing residential cleaning becomes a ‘need’ based on physical ability. It also sits somewhere between need and want as the time and energy it takes to keep homes clean and healthy take a away from precious free time and other priorities. As well, it is a service for the segment of the population with enough disposable income to afford the service consistently on a regular basis. We believe there is plenty of open opportunity for growth.

Real Estate Needs

Real estate needs are minimal and not specialized like a restaurant or retail location. This could be a home office based business, or a small, light industrial office space is all that is necessary.

Competitive Climate

There are certainly lot’s of home cleaning companies and services in virtually any market. However, it is dominated by fairly unsophisticated ‘mom and pops’ who quickly max out on capacity or struggle with maintaining quality/consistency. The main competition will be from the larger franchise systems with more sophisticated marketing and customer acquisition programs. However, there is still considerable room to develop new franchise units in most markets where complete domination by one brand or another does not seem imminent.

Regulatory Climate

Like many industries, the residential and commercial cleaning industries face increasing regulatory scrutiny. But unlike many other industries, the residential cleaning industry regulatory climate is relatively tame compared to others like foodservice, home health care, child care, automotive repair and financial services. According to one industry association the ISSA (International Sanitary Supply Association), regulatory attention seems to focus on cleaning agent ingredients and their potential health impacts. Review the ISSA website for deeper understanding of these issues.

Brand Recognition

The Maids is one of if not the leading brand in the residential home cleaning sector. According to our keyword research, it is one of a very select services consumers search for by name. It’s our estimation the brand will remain focussed on building The Maids brand name recognition to keep it top of mind among consumers into the foreseeable future.

Seven Internal Factors of the Franchise Evaluator™

Scoring Scale: 1 = Lowest 10 = Highest

Revenue Model

The business is about selling a home service to residential customers in a specified trade area you and The Maids will define. The service represents a recurring revenue model in that a customer tends to use these services on a regular basis for an extended period of time. The service is clearly understood by the consumer as are the benefits. You as the franchise will build and manage a team to perform these services dependably and with a consistent outcome, with a focus on high consumer satisfaction for re-occuring revenue and referrals. There also are earning claims in the FDD based on a long operating history. You should review this with the franchisor and competent legal and financial resources.

Franchisee Role

The business is about selling a home service to residential customers in a specified trade area you and The Maids will define. The service represents a recurring revenue model in that a customer tends to use these services on a regular basis for an extended period of time. The service is clearly understood by the consumer as are the benefits. You as the franchise will build and manage a team to perform these services dependably and with a consistent outcome, with a focus on high consumer satisfaction for re-occuring revenue and referrals. There also are earning claims in the FDD based on a long operating history. You should review this with the franchisor and competent legal and financial resources.

Franchising Experience

The Maids has been franchising since 1980. As of September 30, 2021, there were a total of 1,583 franchised and company-owned Territories. A total of 122 franchisees licensed and operated 1,423 of the 1,583 Territories. The Maids operates the remaining 160 Territories.

Leadership

Mr. Kirwan joined us as Vice-President and Chief Financial Officer in January 2001. He was promoted to Executive Vice-President Operations, Treasurer on January 1, 2003. In September 2010, he was promoted to Chief Operating Officer. In March 2020, he was promoted to his current position. Mr. Kirwan has been a member of our Board of Directors since November 2002.

Franchisee Engagement

The Maids has established an Advisory Council. The Advisory Council is designed to provide us with a regular forum regarding advertising, technology, and other business developments, and to provide you with recognized leaders to whom you can turn to for advice. This not required of franchisor, but demonstrates and formal leadership construct to discuss topics germaine to the system as a whole. While more is still needed to learn about the Council, it is a positive sign of collaboration.

Financial Health

According to the most recent documents outlined in the FDD, The Maids is in sound financial health.

Operational Systems

There is a clearly defined system for starting your The Maids business as well as ramping up. There is a Chief Learning Officer who has been with the company for over 20 years, has established and manages this comprehensive system. As well, it is stated most of the senior executives will be involved in training. There as clear steps and stages in the FDD. You should review this with the franchisors.

Total Franchise Evaluator™ Score

External Total Score

Internal Total Score

Total Score

More investigation is needed

Worth exploring further with caution

Add to consideration set

Sound opportunity and likely a great fit

Summary

This a simple business model, based on a clearly understandable consumer need, with macro industry drivers expanding the customer base of the industry. Along with being a leading brand in the category and highly experienced and engaged executive team, this is a system we would invite closer scrutiny.